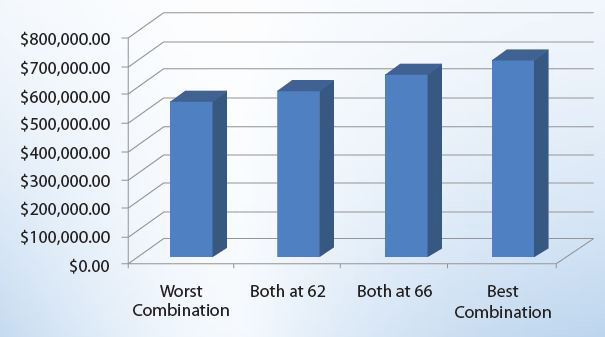

The difference between the best and worst possible decision of when to elect can be over $100,000.

What’s at Stake?

Case Study: A 62-year old couple with one above average earner (PIA $1,800) and a lesser earning spouse (PIA $1,000), who both live to average life expectancy could lose over $60,000 in family benefits by making the worst decision for when to take Social Security.

If they both elect at age 62, they could be losing over $50,000.If they both elect at age 66, this couple could still be leaving $30,000 on the table.Simply delaying benefits isn’t the answer either. If they both delay to 70, they could be losing over $40,000.

Creating a proper strategy to maximize Social Security should be a part of everyone’s retirement plan.

What if you could analyze hundreds of election age combinations and determine which was the best option for you?

The Solution

Family Benefits Analysis

Using software analysis we determine a strategy to maximize Social Security: we examine hundreds of possible combinations, including 81 possible age combinations across nine possible election strategies and find the one option that offers the highest expected lifetime benefit.

We provide a summary of the best, worst and two common election strategies. See the chart below:

Your Social Security Timing Report

With your family Benefit Analysis, you’ll receive a customized report including:

Projected Outcomes for Best/Worst/Common Election Choices.”Map” of expected outcomes for each election age combination.A maximized strategy solution that could further optimize your Social Security income.

Why Maximize Social Security?

For most people, Social Security is the only income stream that:

Is adjusted annually to keep up with inflation.Is tax-advantaged—at worst, it’s only 85% taxable as ordinary income.Will continue to pay you for as long as you live.Is backed by a government promise.

Make sure you’re not leaving benefits on the table and speak with one of our financial advisor to find out how you maximize Social Security benefits!